At House Mining Investment, we empower investors with the opportunity to earn through our Gold Mining ETF investment. Our unique features provide comprehensive exposure to the gold mining sector, operating well-established projects that consistently generate cash flows and distribute daily profits to our investors in the form of dividends.

Gold mining ETFs hold a diversified basket of publicly traded gold mining stocks and related companies, including those involved in exploration, production, and processing. By owning shares of these firms, our ETFs offer equity exposure to the industry, rather than solely to the price of gold.

In times of prosperity and uncertainty alike, gold has served as a reliable hedge. Similar to other ETFs, our House Mining ETF manager trade Gold ETFs as stocks on major exchangers. House Mining facilitates these transactions, providing investors with competitive commission rates through our contract plans and regular updates.

The primary benefit of Gold ETFs is that they expose investors to gold more easily than traditional methods. Owning gold can help diversify a portfolio and provide a hedge against inflation. ETF shares are highly liquid and can be bought and sold daily on the open market, making it easy to adjust a portfolio’s gold exposure when needed.

ETFs are also transparent—the holdings are published daily, and their costs are clearly stated in prospectuses. Physical gold ETFs are also subject to audit, a crucial peace-of-mind measure given the problems of fraud that have plagued the industry back to the earliest gold coins.

ETFs provide more liquidity, lower costs, and storage ease than owning physical gold. However, physical gold allows true ownership while ETF holders only experience indirect exposure through the fund.

Yes, Gold ETFs can be held in a retirement account like a traditional or Roth IRA. This is beneficial, since holding physical gold in an IRA requires a special gold IRA, which has its own rules and fees.

Physical gold can be held and stored, offering a sense of security to many investors. However, extensive holdings of physical gold require secure storage and insurance, which can be costly and cumbersome. Selling physical gold can also be less convenient and take more time than selling shares of an ETF.

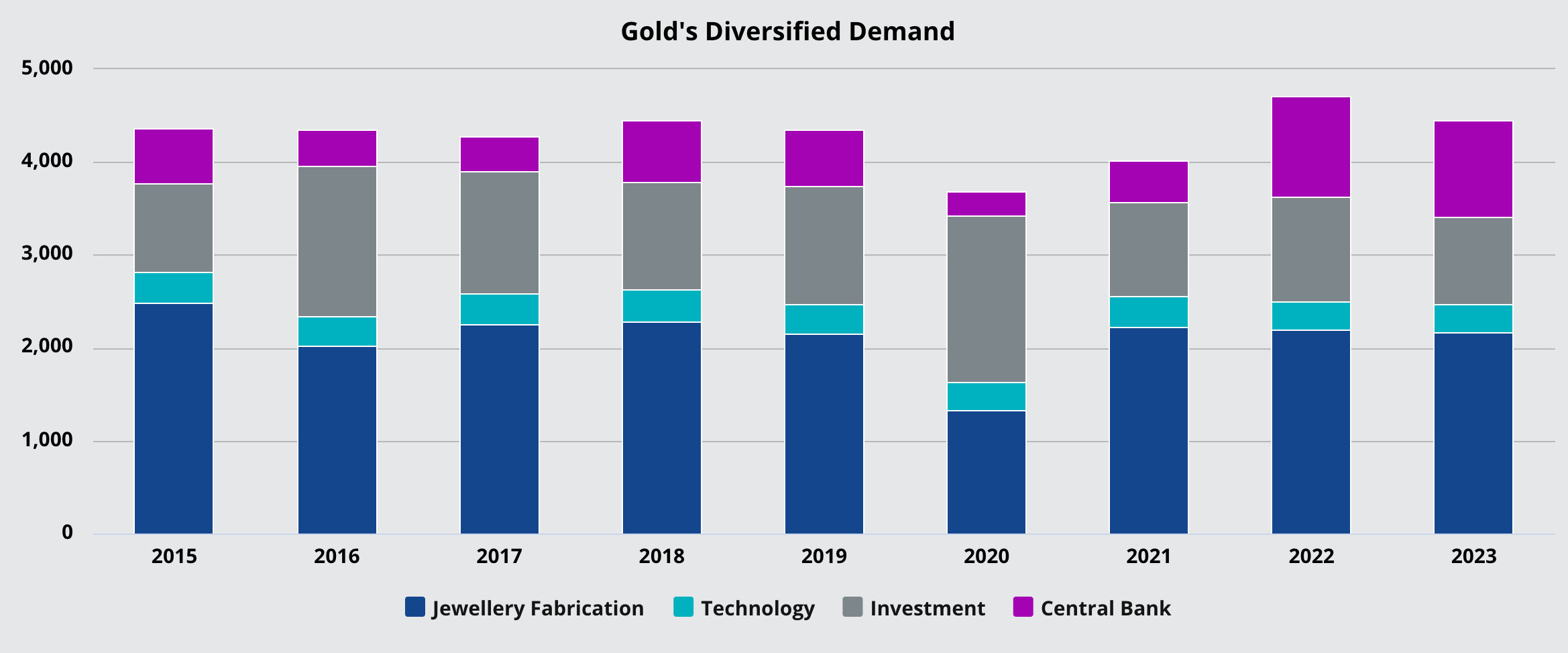

By allocating to this Fund, investors can benefit from the gold miners’ growth potential. This stems from new explorations and gold discoveries as well as from a diversified and stable demand. Gold is in fact characterized by several diversified sources of demand which have proven to be resilient over time.

Demand for gold has historically been diversified and resilient. Gold is in fact used broadly in jewellery and technological devices as well as it is often held as reserve by central banks around the world. Moreover, many investors perceive it as a safe haven and inflation hedge for their portfolios, thus seeing a clear investment rationale for the precious metal. All these use cases underscore the robustness of gold’s demand, with the Gold ETF poised to potentially benefit from it.

Gold miners are trading at a significant discount to gold at a time when balance sheets, cash flow generation and capital allocation strategies have never been stronger.

Create your username, password, and email with House Mining Investment

Explore and evaluate House Mining Investment’s trading contracts,that best suits your financial goal

Fund to invest in your desired contract plan or reinvest funds from an existing acount balance

© Copyright 2025 House-mining.com. All rights reserved.