While traditional assets like stocks and bonds are traded on the public markets, investors have many different investment options open to them for their finances and alternative investment strategies such as real estate are less sensitive to the movements of global markets. More and more investors are shifting to alternatives to help them achieve their goals. As part of our series of instructions on Investing for Beginners, we will take a look at how to invest in real estate to build your wealth.

Real estate is often referred to as concrete gold because it generally means security and value retention. Investors are always on the lookout for inflation protection, especially in times when central banks are pursuing an expansionary monetary policy. Low fluctuations in value and attractive income distributions, e.g. via rental income, also motivate many investors to invest in real estate.

Investing in real estate can offer a number of benefits:

Investing in real estate is something many people associate with buying a property for investment purposes, such as a residential building or even a commercial rental property. But there are other options.

Although less well known, you can also make an investment in real estate through a mutual fund. There are many different varieties of real estate funds as well as Real Estate ETFs. With some of them, your investment may be tied up for a long time. For others, the minimum investment is very high.

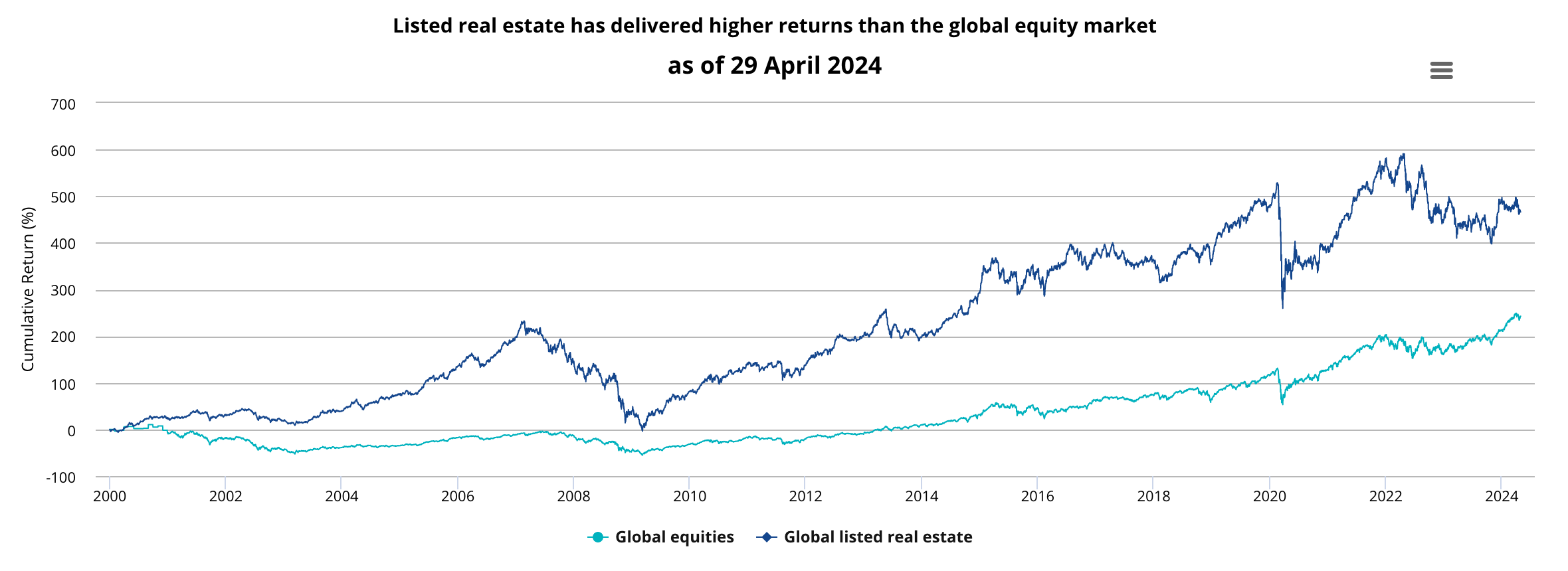

To invest in real estate, passive Real Estate ETFs offer an attractive alternative to actively managed real estate funds. The reasons for this are that they charge higher fees, often tie up the invested capital for a long time, and may require an extremely high minimum investment. Compared to actively managed real estate funds, Real Estate ETFs are characterized by higher liquidity, flexibility and lower costs.

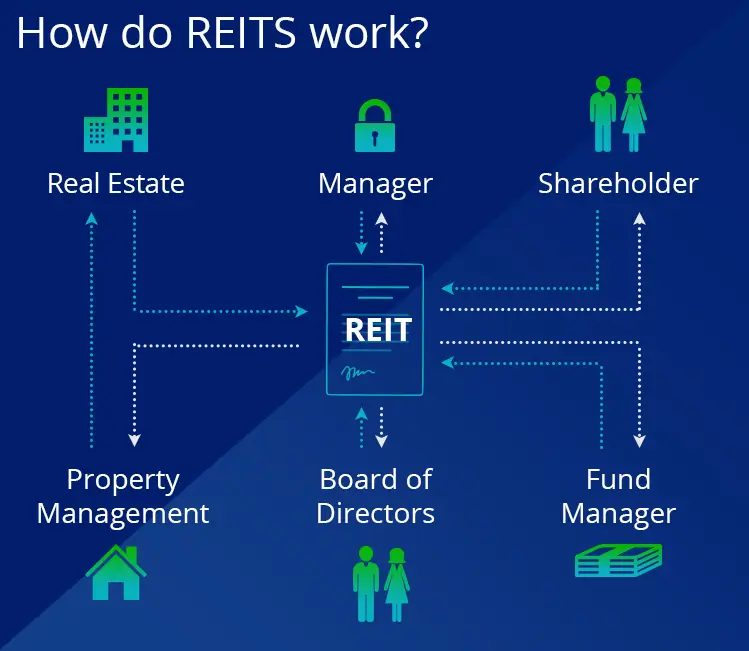

Listed real estate shares include companies that invest in real estate primarily and whose shares are traded on the stock exchange. These real estate shares are often referred to as Real Estate Investment Trusts or REITs. You will often read terms like REIT funds or REIT ETFs or REIT investments in various financial journals.

A REIT is a company that owns one or more income-producing properties.

REITs are often exempt from paying taxes on operating profits to avoid double taxation for investors. When you buy a share in this type of company, you are effectively buying a share in a real estate portfolio.

There are two types of REITs – listed REITs, also known as exchange-traded REITs, and unlisted REITs. Unlisted REITs are not listed on the stock exchange, but are one of the available investment options.

Listed real estate shares offer a number of advantages of investing in real estate compared to their unlisted alternatives:

Liquidity: Due to the listing of the real estate shares, you can enter and exit at any time when the stock exchange is open and bid and asking prices are offered.

Low minimum investment volume: The minimum investment is very small and corresponds to the price of a share, which is usually in the range of a few dozen euros.

Investing in real estate brings diversification by country: Real estate shares as well as Real Estate ETFs usually invest in a specific region. Investing in different real estate shares allows you to diversify your investments across sectors and regions.

Diversification by sector: Aspect of Investing in real estate is diversification. There are several hundred listed real estate shares worldwide. For example, there are real estate companies that specialize in a particular sector:

Create your username, password, and email with House Mining Investment

Explore and evaluate House Mining Investment’s trading contracts,that best suits your financial goal

Fund to invest in your desired contract plan or reinvest funds from an existing acount balance

© Copyright 2025 House-mining.com. All rights reserved.